Recently four guys from the area contacted me. Together they planned on purchasing over a dozen rental properties. Each brought something to the table: capital to finance the project, construction and rehab skills, accounting and paperwork, and experience with rental properties. The one with the experience was the one who insisted they set up a Limited Liability Company (LLC) and carefully design their Operating Agreement.

The partner with experience knew that often times businesses don’t work out as planned, and reality often differs from projections. So these partners asked me to draft an Operating Agreement that not only detailed how the LLC was to be managed, who had decision making power, what decisions required only one partner’s signature and what decisions required all partners to sign, but also what we call “off ramps”.

“Off Ramps” are designed exit strategies from the business. These can be voluntary or involuntary. If a partner decides to retire and move from the area, an “off ramp” has already been designed in the LLC’s Operating Agreement to allow for voluntary withdrawal. Or if a partner stops pulling his weight and decides to let his other partners do all of the work, an involuntary “off ramp” exists where that partner’s interest can be bought out based on a pre-determined formula.

If you’re in business with partners, you need to have a carefully crafted partnership agreement. Local area accountants often refer individuals interested in creating an LLC or other business entity to our office. If you’re thinking of starting a business, let us help you get started on the right foot. We can assist you with getting your Missouri LLC up and running quickly.

Blog

While trusts can be confusing at first to the lay person, trusts can be a valuable estate planning tool. Common types of trusts in Missouri include:

• Revocable Living Trusts. Becoming increasingly popular for Missouri residents because it allows families to avoid the court-supervised Probate procedure at death and provides for a faster and less-costly estate settlement at death. A Revocable Living Trust (RLT) can be extra beneficial if you own real estate in other states allowing your family to avoid multiple probates.

• Trusts for Minors. If there’s a chance your minor child or minor grandchild will inherit assets from you, then you need to make sure those assets will be placed in trust so the courts won’t need to supervise the minor’s assets and so that the minor will be protected from squandering the assets when he or she reaches the age of 18.

• Trusts to Minimize Estate Tax. Not as popular now since the estate tax exemption has increased from $600,000 to $5,490,000, but if estate taxes are a concern, you need to consider these irrevocable trusts.

• Special Needs Trusts. If you have a child or loved one with special needs, make sure any inheritance you leave that child is placed in a Special Needs Trust. This will help the child continue to receive government benefits (Medicaid and/or Medicare) while using the funds you put in their Special Needs Trust to supplement their care.

• Trusts for Blended Families. These are especially popular when a spouse has children from a prior marriage. A trust for a blended family is a way to make your assets available for your spouse after you die, but when your spouse later dies, the trust assets will revert back to your heirs, not your spouse’s heirs.

• Charitable Trust. A vehicle which allows you to transfer appreciated assets to a charity, have them sold with no tax consequences, receive an income off those assets for your lifetime, and at your death the remaining trust assets are passed along to your favorite charity or charities.

If you are interested in learning more about planning options for you and you loved ones, I’m happy to help. You can reach me at my law office in Cape Girardeau at 573-334-5125.

Been working with a New Madrid family that has worked hard over the last several decades and have accumulated an estate that is likely to cause there to be federal estate tax when they die. They were anxious to determine what needed to be done to reduce the ultimate federal estate tax burden.

We had a fairly in depth discussion about the pros and cons of annual gifting to their descendants – and perhaps even the spouses of their descendants. In particular, they wanted to know if they could back-date transfers so that it would appear that the transfers were made last year – enabling them to reduce the value of their estate even further.

I hated to burst their bubble, but I had to be the bearer of bad news. They could not, this year, do transactions that would appear to have been made last year or the year before. They thought, just maybe, that if the check was dated last year, that would be OK even though the check was deposited by the donee until this year.

That’s why it is so important that you get the education you need so that you can take advantage of tax reduction and other estate protection techniques that can be taken advantage of if you act early in the process.

Today I had a phone call from a potential client. She had just received a notice that her wages were going to be garnished. She was concerned that if her wages were garnished her family wouldn’t be able to pay their remaining bills to keep the lights on and food in the pantry. A co-worker of hers had suggested a Chapter 7 bankruptcy. She was interested in the “fresh start” that offered but was concerned if she could keep her vehicle if she filed bankruptcy. She explained that her vehicle was only a year old, she was current on her payments, and some other details.

I was able to assure that if she wanted to, she could keep her car. The choice was hers.

If you are considering bankruptcy, it is important to consider the different factors in your specific case that will affect the answer for you. These factors include:

- The amount of equity you have in the vehicle. Equity is the amount your car is worth minus any debt you owe on it.

- Whether you are current (or can get current) on your car payments.

- Whether you want to keep your car. You have the option of surrendering your vehicle as part of your fresh start.

Recently I worked with a family who had a family farm just outside Cape Girardeau county. They told me they had three main estate planning concerns.

First, they had two kids. They wanted to make sure that when they were gone, their son and daughter would be treated fairly. It was also important to them that no decision regarding their property could be made without both their son and daughter agreeing to it.

Second, they had about 150 acres. The husband’s father had gone spent several years in a nursing home so he had first-hand experience with his family having to “spend down” their hard-earned savings to pay for his nursing home care. The husband wanted to know what was available so that his wife and kids wouldn’t have to go through a similar experience.

Third, they were involved in a small business and wanted to arrange their affairs so that if they were sued, that no one could take their home away from them.

There are certain types of revocable trusts, irrevocable trusts, and limited liability companies that can be set up in Missouri which can help families solve these problems.

Last week we held 2 estate planning workshops – one in Cape Girardeau and one in Jackson. The major purpose of these workshops is to educate individuals about what happens with no planning and the difference planning can make. I have yet to have someone attend the workshop and tell me that they didn’t learn something of benefit to them.

At the most recent workshop we covered topics that we often get questions about:

- What happens to me and my property if I can’t manage it anymore?

- What is probate?

- I’ve got a Last Will & Testament. I’m fine, right?

- What is a trust and why are they so popular?

- How can I protect my property from the nursing home?

Our next workshop will be in April. If you would like to attend, call our office at 573-334-5125 or send us an email at frontdesk@capegirardeaulaw.com.

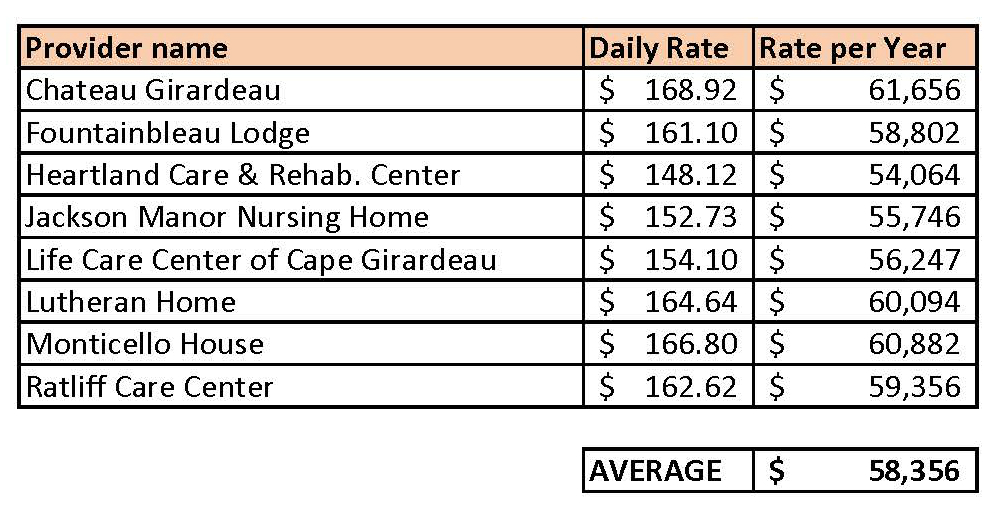

As an attorney focused on Elder Law, many clients ask me, “How much does a nursing home around Cape Girardeau cost?”

The answer is that it depends on which facility you go into. Different facilities have different rates… and they change frequently.

As of November 1, 2016, here is the cost of skilled nursing facilities in Cape Girardeau County. If you know of someone who is concerned that they will lose most or all of their hard-earned assets due to nursing home costs, we can help. Just call.

The first time I was asked to assist with a bankruptcy case, my initial reaction was, “OK, I’ll take one for the team, but this isn’t something I want to do.”

That first case completely changed my perspective. It was a mom and dad who had 2 young kids. In the past the dad had a very good job as a truck driver hauling hazardous materials. The previous year, he lost that contract and his earnings dropped by over 60%. That same year, his wife was injured and required a number of medical procedures. In the space of a few months, they went from being a stable family of four living within their means, to being in debt, behind on payments, and with medical collection agencies calling them constantly for unpaid medical bills. And if this family could have paid those bills, they would have. The money simply wasn’t there.

We were able to use the bankruptcy laws to help this family get a fresh start. They were able to erase roughly $50,000 of debt. This allowed them a FRESH START. Once again, they were able to save for their kids college and think of a positive future.

And they loved me and were very grateful to me for helping them get that Fresh Start. But the truth it, all I did is walk them through the process of applying the bankruptcy laws on their behalf. Yet, they were SO GRATEFUL.

That has been a common theme among many of my bankruptcy clients. They never wanted to be behind on bills, fear having their wages garnished, or switch phone numbers just to avoid harassing collection phone calls. And we are able to STOP that… and help them START FRESH.

If you are in need of IMMEDIATE DEBT RELIEF, we may be able to help you get that FRESH START.

Our new office location is in Cape Girardeau at 2007 Independence Street. That’s near the new Walmart Neighborhood Market and in between John’s Pharmacy and the Grecian Steakhouse.

Mailing Address is:

Law Office of Mark McMullin

2007 Independence Street

Cape Girardeau, MO 63703

Example. Kirk and Lisa wanted to make their estate settlement simple for each other and for their three children. Knowing that assets in a revocable trust avoid probate, they created a trust and transferred their stock, home, LLCs into their trust. Kirk and Lisa “heard” that life insurance avoid probate because it’s paid to the beneficiary. Kirk died. The insurance company immediately tells Lisa that the insurance company needs a probate court order. Why?

Many years ago, insurance agents would sell life insurance to a married couple. Because the insurance agent believed there would be some estate tax savings, the insurance agent wrote the insurance applications in a way that the husband would “own” the life insurance policy on the life of the wife, and the wife would “own” the policy on the life of the husband.

So, when Kirk died, it was determined that Kirk “owned” the policy on Lisa’s life. When Lisa dies, the death benefit will be payable to Kirk (or Kirk’s estate). In either case, Kirk’s probate is necessary to collect the death benefit when Lisa dies. In addition, if the policy that Kirk owns has cash value, Lisa will not be able to access this cash value into the policy ownership gets transferred in a court proceeding.

Had they transferred their life insurance policy to their trust during Kirk’s lifetime, the probate would not have been necessary. After Kirk died, Lisa, as the sole trustee, would be able to access cash value or change the beneficiary. But since they “assumed” that life insurance avoided probate, they ended up being required to complete Kirk’s probate to “fix” the life insurance problem, even though all of their remaining assets avoided probate.