While trusts can be confusing at first to the lay person, trusts can be a valuable estate planning tool. Common types of trusts in Missouri include:

• Revocable Living Trusts. Becoming increasingly popular for Missouri residents because it allows families to avoid the court-supervised Probate procedure at death and provides for a faster and less-costly estate settlement at death. A Revocable Living Trust (RLT) can be extra beneficial if you own real estate in other states allowing your family to avoid multiple probates.

• Trusts for Minors. If there’s a chance your minor child or minor grandchild will inherit assets from you, then you need to make sure those assets will be placed in trust so the courts won’t need to supervise the minor’s assets and so that the minor will be protected from squandering the assets when he or she reaches the age of 18.

• Trusts to Minimize Estate Tax. Not as popular now since the estate tax exemption has increased from $600,000 to $5,490,000, but if estate taxes are a concern, you need to consider these irrevocable trusts.

• Special Needs Trusts. If you have a child or loved one with special needs, make sure any inheritance you leave that child is placed in a Special Needs Trust. This will help the child continue to receive government benefits (Medicaid and/or Medicare) while using the funds you put in their Special Needs Trust to supplement their care.

• Trusts for Blended Families. These are especially popular when a spouse has children from a prior marriage. A trust for a blended family is a way to make your assets available for your spouse after you die, but when your spouse later dies, the trust assets will revert back to your heirs, not your spouse’s heirs.

• Charitable Trust. A vehicle which allows you to transfer appreciated assets to a charity, have them sold with no tax consequences, receive an income off those assets for your lifetime, and at your death the remaining trust assets are passed along to your favorite charity or charities.

If you are interested in learning more about planning options for you and you loved ones, I’m happy to help. You can reach me at my law office in Cape Girardeau at 573-334-5125.

Category - Avoid Estate Tax

Been working with a New Madrid family that has worked hard over the last several decades and have accumulated an estate that is likely to cause there to be federal estate tax when they die. They were anxious to determine what needed to be done to reduce the ultimate federal estate tax burden.

We had a fairly in depth discussion about the pros and cons of annual gifting to their descendants – and perhaps even the spouses of their descendants. In particular, they wanted to know if they could back-date transfers so that it would appear that the transfers were made last year – enabling them to reduce the value of their estate even further.

I hated to burst their bubble, but I had to be the bearer of bad news. They could not, this year, do transactions that would appear to have been made last year or the year before. They thought, just maybe, that if the check was dated last year, that would be OK even though the check was deposited by the donee until this year.

That’s why it is so important that you get the education you need so that you can take advantage of tax reduction and other estate protection techniques that can be taken advantage of if you act early in the process.

I’m a note-taker. Usually you will find me with a blue ink pen and legal pad in hand, ready to take notes on whatever is being discussed. Recently, I came across one of my legal pads that had the following notes: Top 10 Reasons for Creating an Estate Plan from “The Everything Wills & Estate Planning Book” by Deborah S. Layton. I like the list because she outlines some of the major benefits of estate planning in layman’s terms.

- A sound estate plan can save your family thousands of dollars in taxes and legal fees.

- If you don’t have a plan, the government will decide who will receive your property.

- If you don’t have a plan, your spouse or partner may not receive the property you intended to provide.

- Most people can avoid or reduce estate taxes with the right plan.

- Naming a legal guardian in your will is the way to choose who will raise your minor children if you are gone.

- Creating a durable power of attorney ensures that someone can pay your bills and sign legal documents if you become disabled.

- Have a medical directive will provide guidance about your health care wishes in the even you become incapacitated.

- You can avoid the unexpected results of owning property in joint name when you understand the rules.

- You can make gifts to your favorite charity to reduce estate taxes but still provide for your family.

- A good estate plan can preserve your assets for your children’s use and prevent them from wasting those assets.

In just a few weeks, we will elect a new president. Recent polls have Hillary in the lead. Regardless of whether you agree with Bill and Hillary’s politics, we can learn a few things from them about smart estate planning strategies. A recent Time.com article reveals that Bill and Hillary have set up a variety of trusts.

First, the Clintons have a “qualified personal residence trust” for their home in Chappaqua, New York. The purpose of the “qualified personal residence trust” is lock-in a low value for a piece of real estate before it appreciates. In most cases, the result is that while the value of property transferred to the trust is subject to estate tax, any appreciation on the property is not. With the estate tax at 40%, the resulting savings can be huge.

Second, the Clintons set up Irrevocable Life Insurance Trusts (ILIT). It is reported that Bill and Hillary have 5 different life insurance policies, 3 of which are in ILITs. The benefit of the Irrevocable Life Insurance Trusts is that you can minimize or completely avoid tax. By using ILITS, Bill and Hillary will likely allow the death benefits of their large life insurance policies to pass to their daughter, Chelsea, outside of their estate, which means it will not count towards their estate tax exemption ($5.45 million per person in 2016).

If Bill and Hillary Clinton take advantage of the tax laws, so should you! ILITs are a common estate planning tool we use for high net worth individuals including small business owners and farmers. It’s only fair that you have the opportunity to use the same estate planning tools that the Clintons are using.

The simple answer has 2 parts.

Each individual has an “annual exclusion” that allows them to give $14,000 per year to any number of individuals, without paying any gift tax. That means a wealth grandmother can give her 3 kids $14,000 each and each of her 7 grandchildren $14,000 each. The grandmother could give $140,000 (or more), each year, with no IRS reporting requirements.

Keeping it simple: Annual Exclusion = $14,000 (2016)

The issue becomes for gifts above $14,000. Gifts above $14,000 begin to apply to your “lifetime exclusion”. In 2016 the lifetime exclusion is $5,450,000. That is a large amount of money and does not apply to most people. However, if you make a gift above $14,000, you must report to the IRS using a gift tax return when you made the gift and the amount of the gift so it can be deducted from your lifetime exclusion. I have yet to meet anyone who enjoys reporting additional information to the IRS. By keeping gifts to $14,000 or less and giving to multiple individuals, you avoid those reporting requirements.

Keeping it simple: Lifetime Exclusion = $5,450,000 (2016)

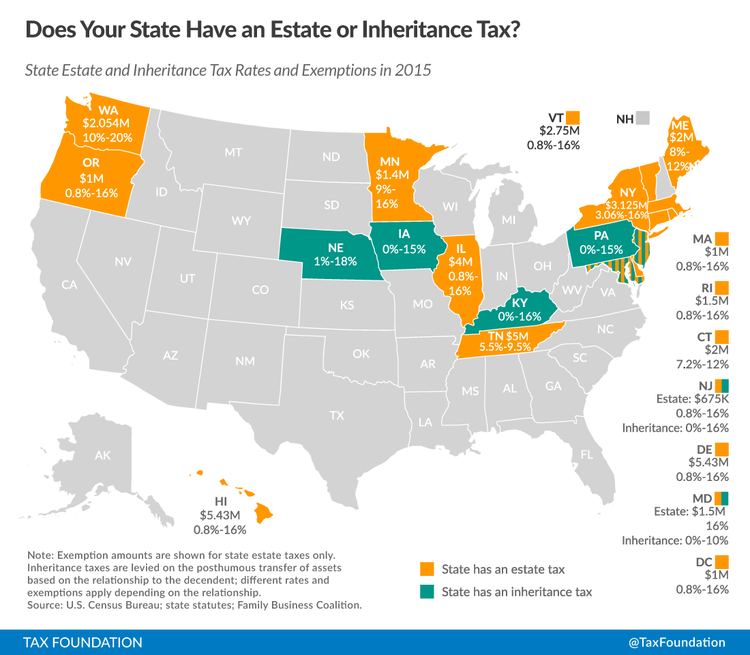

A previous posting discussed Estate Tax at the federal level. It is important to know that some states impose an estate tax as well. Thankfully Missouri is not one of them.

The Tax Foundation published this map which shows a 50 state survey of which states have a state estate or inheritance tax.